Excitement About Custom Private Equity Asset Managers

Wiki Article

Not known Factual Statements About Custom Private Equity Asset Managers

(PE): investing in companies that are not publicly traded. Approximately $11 (https://cpequityamtx.carrd.co/). There may be a few points you do not understand about the industry.

Partners at PE firms raise funds and manage the cash to yield favorable returns for shareholders, normally with an investment horizon of between four and 7 years. Private equity firms have a range of investment preferences. Some are rigorous sponsors or easy capitalists entirely based on administration to grow the business and generate returns.

Since the very best gravitate toward the bigger bargains, the middle market is a substantially underserved market. There are a lot more sellers than there are highly skilled and well-positioned money experts with substantial purchaser networks and resources to take care of a deal. The returns of exclusive equity are typically seen after a couple of years.

The Only Guide to Custom Private Equity Asset Managers

Traveling listed below the radar of big multinational corporations, a lot of these tiny firms commonly provide higher-quality client service and/or niche product or services that are not being provided by the huge empires (https://www.youmagine.com/cpequityamtx/designs). Such upsides draw in the interest of exclusive equity firms, as they have the understandings and savvy to manipulate such chances and take the company to the following degree

Personal equity investors have to have trusted, capable, and dependable monitoring in place. The majority of managers at profile companies are offered equity and perk settlement structures that compensate them for hitting their monetary targets. Such alignment of goals is typically called for before a bargain gets done. Personal equity opportunities are typically unreachable for individuals that can't spend millions of dollars, yet they should not be.

There are policies, such as restrictions on the aggregate amount of money and on the number of non-accredited financiers. The exclusive equity business draws in a few of the very best and brightest in company America, consisting of top entertainers from Lot of money 500 firms and elite management consulting firms. Legislation firms can visit homepage likewise be hiring premises for exclusive equity works with, as accounting and legal skills are necessary to complete deals, and transactions are highly searched for. https://parkbench.com/directory/custom-private-equity-asset-managers.

Our Custom Private Equity Asset Managers PDFs

An additional downside is the lack of liquidity; as soon as in a personal equity transaction, it is hard to leave or market. There is a lack of flexibility. Personal equity also features high costs. With funds under monitoring already in the trillions, exclusive equity firms have actually ended up being eye-catching investment lorries for affluent people and organizations.

For years, the characteristics of personal equity have actually made the asset class an eye-catching proposal for those that can participate. Since accessibility to exclusive equity is opening up to more private capitalists, the untapped potential is ending up being a fact. So the question to consider is: why should you invest? We'll begin with the primary disagreements for purchasing exclusive equity: How and why private equity returns have historically been greater than various other properties on a variety of degrees, Just how consisting of exclusive equity in a profile affects the risk-return profile, by assisting to expand against market and cyclical risk, Then, we will describe some crucial factors to consider and dangers for exclusive equity capitalists.

When it involves presenting a new property right into a portfolio, the most standard factor to consider is the risk-return profile of that property. Historically, exclusive equity has shown returns comparable to that of Arising Market Equities and higher than all other conventional asset courses. Its fairly low volatility paired with its high returns produces a compelling risk-return account.

Getting The Custom Private Equity Asset Managers To Work

In fact, private equity fund quartiles have the best variety of returns throughout all different asset courses - as you can see below. Method: Inner rate of return (IRR) spreads computed for funds within vintage years individually and afterwards balanced out. Average IRR was determined bytaking the standard of the median IRR for funds within each vintage year.

The impact of adding private equity right into a portfolio is - as constantly - reliant on the portfolio itself. A Pantheon research from 2015 recommended that including exclusive equity in a portfolio of pure public equity can unlock 3.

On the other hand, the most effective exclusive equity firms have access to an even bigger pool of unknown chances that do not deal with the exact same analysis, along with the sources to execute due persistance on them and recognize which deserve buying (TX Trusted Private Equity Company). Investing at the very beginning indicates greater danger, however for the business that do be successful, the fund benefits from higher returns

Custom Private Equity Asset Managers Things To Know Before You Buy

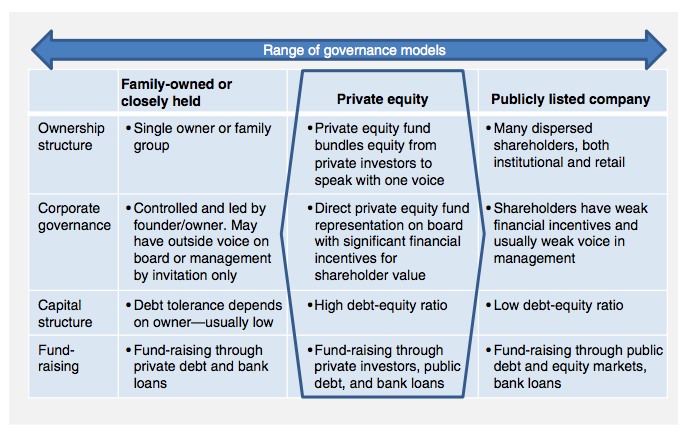

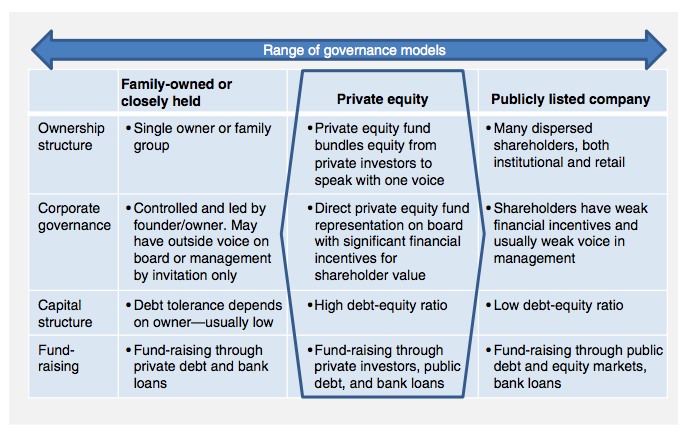

Both public and private equity fund managers commit to investing a percentage of the fund but there remains a well-trodden issue with aligning interests for public equity fund management: the 'principal-agent problem'. When an investor (the 'principal') hires a public fund manager to take control of their capital (as an 'representative') they pass on control to the supervisor while preserving possession of the properties.

In the instance of exclusive equity, the General Partner doesn't simply make a management cost. Personal equity funds also minimize one more form of principal-agent trouble.

A public equity investor eventually desires something - for the management to increase the supply cost and/or pay returns. The financier has little to no control over the choice. We showed above exactly how numerous exclusive equity methods - especially bulk buyouts - take control of the operating of the business, ensuring that the long-lasting value of the business comes initially, raising the return on investment over the life of the fund.

Report this wiki page